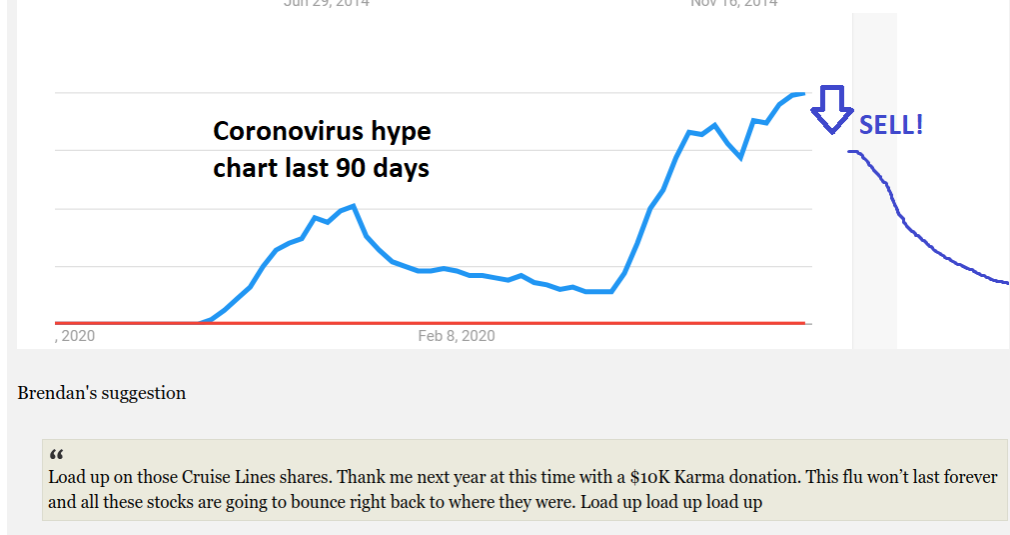

Stock markets around the world have crashed and burned due to the coronavirus outbreak. A variety of sectors have been hit hard especially the travel industry. Investors have been selling off their stocks in a panic as prices sink and not re-investing their funds out of growing fears.

With so many people have sold off their stocks as the markets sink, or have wanted to, it is time for you to be greedy when others are fearful. Individual stocks have moved up and down over the last few weeks, but as a whole, the markets are doing poorly.

With so many people have sold off their stocks as the markets sink, or have wanted to, it is time for you to be greedy when others are fearful. Individual stocks have moved up and down over the last few weeks, but as a whole, the markets are doing poorly.

Watch the video and share your tips on forum here (Members only)

It is a common strategy used by successful investors to buy up stocks when others panic. The coronavirus outbreak makes it a perfect time gobble up low-priced stocks from a variety of well-thought-out purchases.

The United States is expected to see things get worse before they get better. Therefore, it is the best time to get stocks such as airline, cruise ship, and other travel sectors in your portfolio. In addition, it may not be a bad idea to purchase stocks in clothing, restaurants and other entertainment companies. As people sit around at home, the urge to make purchases is high. In addition, like travel, once the coronavirus pandemic ends, people will be chomping at the bit to get out and enjoy life once more.

The United States is expected to see things get worse before they get better. Therefore, it is the best time to get stocks such as airline, cruise ship, and other travel sectors in your portfolio. In addition, it may not be a bad idea to purchase stocks in clothing, restaurants and other entertainment companies. As people sit around at home, the urge to make purchases is high. In addition, like travel, once the coronavirus pandemic ends, people will be chomping at the bit to get out and enjoy life once more.

Another stock that is being kicked around as a possible gold mine later this year is Disney. When the parks re-open and people around the world head out on vacation, many will choose to visit a Walter Disney theme park.

Another stock that is being kicked around as a possible gold mine later this year is Disney. When the parks re-open and people around the world head out on vacation, many will choose to visit a Walter Disney theme park.

Dow Jones this year:

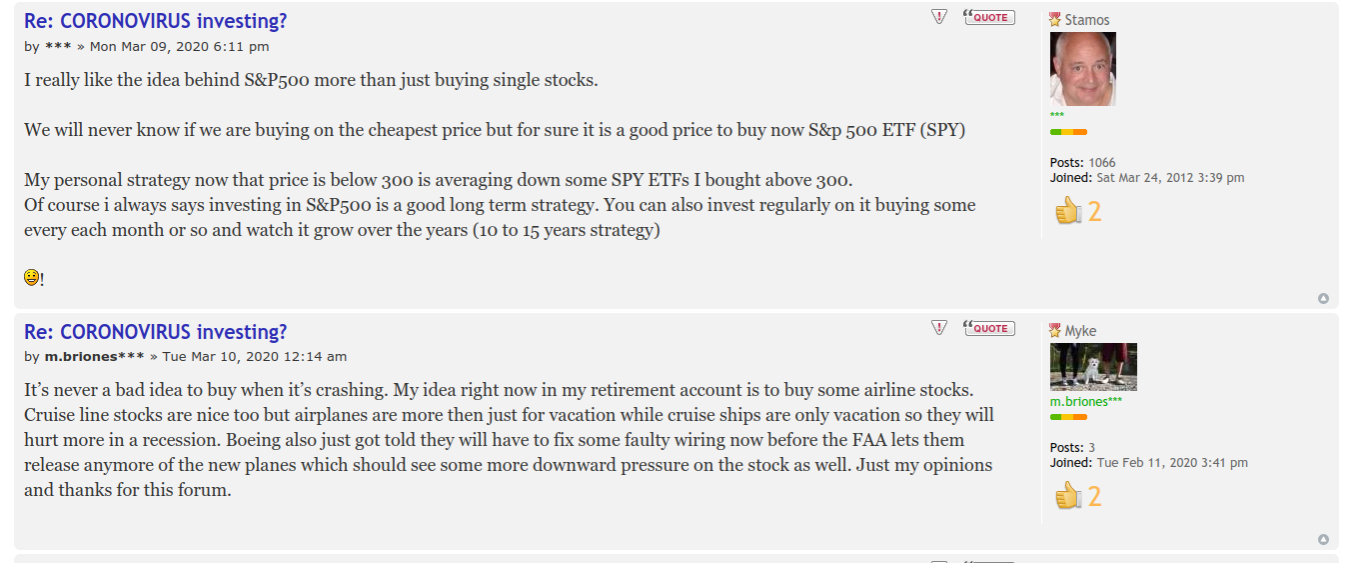

Zcode System’s expert community of sports bettors and financial investors share their knowledge with each other. Investing advice and insight can be found via Zcode System’s VIP Club. It is the perfect way to gain an idea of what other individuals are thinking and doing.

Where to invest?

One of the most popular places to invest money is the S&P 500. Founded in 1993, the S&P 500 is the world’s largest exchange-trade fund.

The S&P 500 is one of the easiest ways for stock traders to access a stock index. The ETF is not as volatile as other stock markets and that is why so many traders are attracted to it. S&P 500 is perfect for long-term investing.

How to invest?

Stocks are impossible to predict. Let’s be real, stocks are just gambling but rather than putting your money on a horse to win a race or football team to win the Super Bowl, you are handing your money to a company in hopes it becomes massive.

One of the best strategies to use when investing is the Dollar-Cost Averaging (DCA) strategy.

Investopedia defines DCA: “Dollar-cost averaging (DCA) is an investment strategy in which an investor divides up the total amount to be invested across periodic purchases of a target asset in an effort to reduce the impact of volatility on the overall purchase. The purchases occur regardless of the asset’s price and at regular intervals; in effect, this strategy removes much of the detailed work of attempting to time the market in order to make purchases of equities at the best prices. Dollar-cost averaging is also known as the constant dollar plan.”

Due to the volatility of the markets thanks to the coronavirus, using the DCA strategy could be a great way to invest and make money over the long-term. Who knows, you could be swimming in profits this time next year. Don’t be afraid the be greedy when others are fearful.

If you are looking for great investing tips and trends to follow, then you need Zcode System. Become a member of Zcode System today to get insight and information from our community of sports bettors and investors today. With traditional sports canceled, Zcode System offers you the chance to explore esports, investing, or other next-gen sports to win profits like never before.

P.S. Upgrade to Zcode VIP Club and Unlock All Winning Picks. Instant Access.