In the financial world, Contrarian Investing is an investment strategy characterized by buying and selling in contrast to the prevailing sentiment at the time. This is also a basic investment strategy for sports betting. Fading the public, or betting against the majority, is a proven strategy to be profitable long term in every sport.

Knowing the public side of every game is important but that by itself will not tell the entire story. Monitoring line movement throughout the day and recognizing the books reaction to the market can offer great opportunities for profit.

We can look at the Boston Red Sox vs Chicago White Sox game as a clear cut example. On the surface, we know David Price, a former Cy Young winner, is making his first start of the season and the Red Sox are a big market team with a strong public following. Our contrarian radar should already be pinging before we even look at the line.

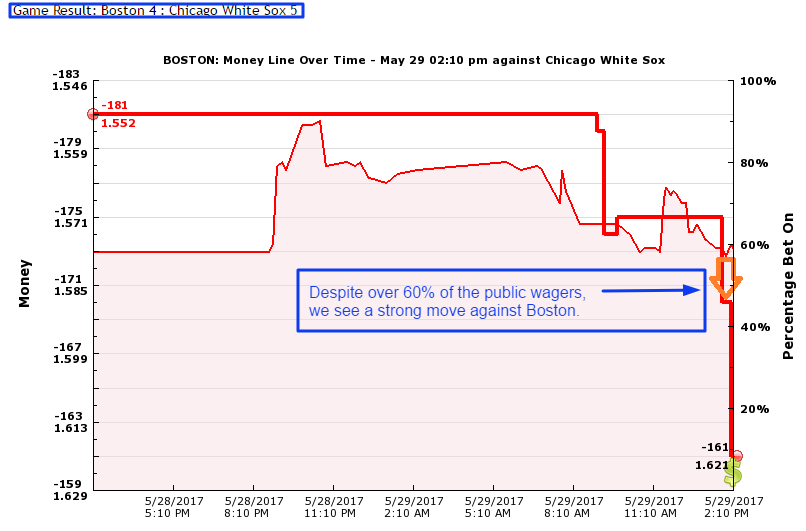

Now we can use the ZCode Line Reversals Tool and the picture becomes very clear:

As you can see, despite heavy public support, the Boston Red Sox line stayed static until a few hours before the game started. Then the line moved against Boston culminating with a huge line reversal minutes before the first pitch. This is caused by sharp money, a large bet or bets from respected sources, on the White Sox.

Of course, despite the media narrative of David Price’s “triumphant” return, the White Sox won, as did smart investors who followed the line movement up until the game started. Obviously, there is no magic technique that wins every time but by thinking contrarian, avoiding the public narrative and following the line movement, we can be profitable over time.

P.S. Upgrade to Zcode VIP Club and Unlock All Winning Picks. Instant Access.