Professional Sports Investing Tools

What is Hedging Calculator and How it Works?

What is Hedging?

Hedging is a risk management strategy used to offset the chances of losses by taking equal and opposite positions on different markets. This technique is commonly used in Financial Markets and we can also use it as a sports investment strategy.

How can I Hedge in Sports Investing?

In this mini-guide, we'll use the an example of match totals in football (or soccer). Typically, the standard totals is either Under or Over 2.5 goals. We'll look at a fixture between two teams: Ipswich Town v Brighton & Hove Albion.

Our bookie is offering the following pre-game prices as follows:

Under 2.5 goals: 2.00

Over 2.5 goals: 1.78

Clearly, if we back both Under and Over goals pre-match, we are going to lose money so how can we Hedge this game?

It is very important to understand that it is not always possible to Hedge a game and make a profit. You have to take advantage of the situation so you see fit.

It is also important to remember that by Hedging, you are sacrificing a large proportion of your potential winnings in exchange for a lower guaranteed return.

Clear? Good, lets move on.

Zcode's Hedging Calculator

http://zcodesystem.com/hedging_calculator/

In Sports Investing, we can use Hedging play laying a second bet in-play against a pre-match bet. As a game progresses, the in-play odds will change and this is where we can use Hedging to our advantage.

In our example game between Ipswich and Brighton, the pre-game odds of 2.00 on Under 2.5 look pretty good to me. The public expect Ipswich to score a lot of goals against Brighton so are backing Over 2.5. However, as a smart Sports Investor, I know Ipswich tend to score more in the 2nd half so this is what we do.

Pre-match, we place a 2.5 unit bet on Under 2.5 goals at odds of 2.00.

Using the Zcode Calculator, we can enter our Back odds of 2.00 (Under 2.5 goals) and Back stake of 25. We can also enter the lay odds of 1.78 (Over 2.5 goals). The calculator tells us:

No hedging opportunity exists at the available odds. You need to wait for better odds before you can hedge.

So where do these better odds come from? The answer is we wait for the in-play odds on Over 2.5 goals to change. As the game progresses, there are no goals so the price on Under 2.5 goals reduces and the price on Over 2.5 goals increases.

Once the Over 2.5 goals price (our lay bet) hits 2.00, we are at break even but we want to win money, not just break even. In the past, I've always looked for 40% return on this specific type of bet which is 1 unit profit but you will need to work out what suits your system best.

To achieve a profit of 40% on our Back Bet, the Zcode Hedging Calculator shows we need odds of 3.34. You need to enter the live odds for Over 2.5 goals in the Lay Bet field. Once you achieve your % target, you can place your Hedge bet (ideally at a different bookie from you pre-game bet). From this point, it doesn't matter what the result is, you will win.

As the Lay Bet (in-play) will have different odds from your pre-match Back Bet, you will need to bet a different amount. The Zcode Hedging Calculator will work this out for your.

Pre-match Back Bet

Under 2.5 goals @2.00 2.5 units Returns 5 units

In-play Lay Bet

Over 2.5 goals @3.34 1.49 units Returns 5 units

The total staked on both bets is 3.99 with a guaranteed return of 5 units. This will give 1.1 units profit regardless of whether Ipswich go on to win by 3 or more goals as expected or Brighton get very lucky and only lose 2-0.

You can use this approach in any sport where you have two opposite bets. These could be:

Money Line

Asian Handicap (Not 3 way)

Match Totals

Team Totals

If you have a Betfair or Betdaq trading account, you will have a wider range of Lay bets and the scope to use the Hedging tool will be wider.

We discussed Hedging previously here:

http://zcodesystem.com/vipclub/forum/phpBB3/viewtopic.php?f=14&t=1272

How Hedging Works on Tennis?

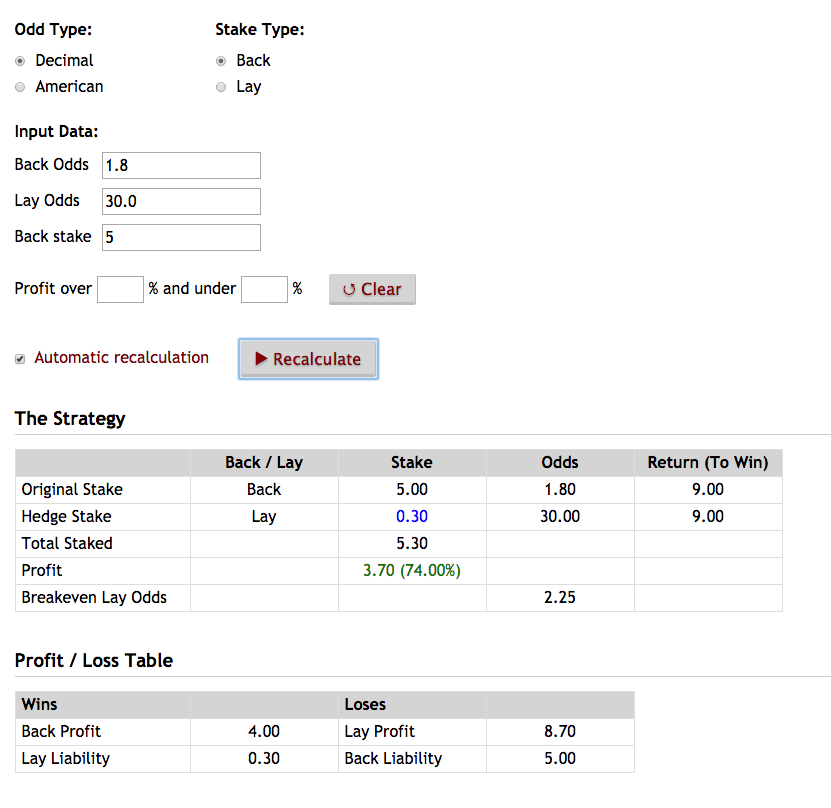

How hedging works in tennis? Here I'll show you an example using our new Hedging Calculator.

Example of a match:

Murray vs Raonic / Murray to win @ 1.80 odds - place 5 units (500$)

Back odds = 1.8

We are currently in game and Murray is leading first set and he's up a break in the 2nd. The odds on Raonic are 30.0

You can simply (LAY) the bet by betting the recommended 0.3 unit on Raonic;

Your calculations will look as following

You need to play around with the tool and adjust it to your liking. I always seek the break even on a hedge. Don't chase profits there, I'm already confident enough in my original bet and I want it to win however anything may happen in sports, especially in tennis therefore hedging allows you just to sit back and relax. Don't sweat over 0.3 unit loss, it's going to pay off a lot in the long run!

Z Code System

Fully Verifiable Winning System Proven Since 1999

Industry Standard In Sports Investing

Get winning picks on MLB, NHL, NBA and NFL